Seeking loans similar to eLoanWarehouse? Delve into a world of financial flexibility and accessibility. These alternatives, spanning from traditional banks to online lenders offer swift solutions tailored to your needs.

With expedited processing and adaptable qualification standards they provide a reliable resource for addressing urgent financial matters. Whether it is Wells Fargo or CashNetUSA explore the array of options available to secure the funds you require minus the exorbitant fees.

These lenders offer swift access to funds, often within the next business day without the exorbitant fees of payday loans. Embrace the flexibility and affordability of personal loans like eLoanWarehouse for your immediate financial needs.

Overview Of Loans Like eLoanWarehouse

In the realm of personal finance alternatives akin to eLoanWarehouse abound offering swift access to funds without the burden of exorbitant fees. Platforms like Beem and CashNetUSA provide seamless solutions for immediate cash needs while peer-to-peer lending platforms like Upstart leverage innovative models to cater to diverse borrowers.

Traditional banks such as Wells Fargo and Chase Bank offer stability and a wide range of loan products, complementing the flexibility of online lenders. Each option brings its own set of features and eligibility criteria ensuring borrowers can find the perfect fit for their financial requirements.

Its installment loans short-term funding or debt consolidation, the landscape of loan options mirrors the dynamic needs of borrowers seeking efficient and affordable financial solutions.

payday loans eloanwarehouse

In the realm of quick financing eLoanWarehouse stands as a beacon offering installment loans akin to payday loans but with more favorable terms. Positioned as a pragmatic choice for individuals with imperfect credit eLoanWarehouse provides swift access to funds without the exorbitant fees associated with traditional short-term lending.

Backed by the Lac Courte Oreilles Band of Lake Superior Chippewa Indians it operates under sovereign status ensuring a seamless and transparent borrowing process. With lenient approval criteria and expedited funding eLoanWarehouse emerges as a reliable alternative prioritizing borrowers’ financial well-being while addressing immediate monetary needs.

Best Popular Loans Like Eloanwarehouse

Discovering the best popular loans akin to Eloanwarehouse unveils a spectrum of options tailored to diverse financial needs. Beem emerges as a leading choice with its instant cash advances, catering to urgent expenses without interest or credit checks.

CashNetUSA stands out for its swift same-day deposits ideal for emergency funding albeit with varying interest rates. Possible Finance offers a unique proposition swiftly disbursing up to $500 without hard credit inquiries potentially aiding in credit improvement.

Chime provides a seamless online banking experience featuring minimal fees and advanced features like early direct deposits appealing to those seeking convenience and flexibility in their financial management.

Beem

Beem stands out as a leading financial solution offering instant cash advances without interest or credit checks through its innovative Everdraft™ feature. Catering to the urgent financial needs of legal residents in the USA over 18 years old Beam provides swift access to funds for bill payments groceries and medical expenses.

With a commitment to financial flexibility and security Beem’s basic plan is free while optional monthly subscriptions offer additional features such as credit monitoring and identity theft protection ensuring a comprehensive financial toolkit for users.

Cashnetusa

CashNetUSA stands as a reliable option for individuals seeking swift access to emergency funds offering same-day deposits for approved loans. With a streamlined application process and brief decision times it caters to urgent financial needs.

While loan amounts may be limited the flexibility to repay on the next payday without prepayment fees adds to its appeal. However borrowers should exercise caution due to potentially elevated interest rates and varying terms across different states. CashNetUSA provides a convenient solution for those facing unexpected expenses.

Possible Finance

Possible Finance stands out as a beacon of financial accessibility offering up to $500 swiftly and without the burden of a hard credit inquiry. With a focus on serving individuals regardless of their credit standing Possible Finance provides a lifeline for those in need of immediate funds.

By reporting installment payments to major credit bureaus, it not only addresses short-term financial challenges but also offers a pathway to improve one’s credit history. Its commitment to transparency and simplicity in the lending process makes Possible Finance a trusted ally for borrowers seeking responsible financial solutions.

You might want to check: How to Cancel BeenVerifiedApp Subscription in Few Minutes?

Chime

Chime revolutionizes banking with its seamless digital platform offering fee-free accounts and advanced features like early direct deposit. Catering to the tech-savvy Chime provides automated savings tools and instant peer-to-peer payments.

Its above-average Annual Percentage Yield (APY) on savings accounts attracts users seeking financial efficiency. With minimal fees and no balance requirements Chime stands out as a modern banking solution. Despite potential out-of-network ATM fees its user-friendly interface makes managing finances hassle-free.

Onemain Financial

OneMain Financial stands as a beacon for borrowers with varying credit profiles, prioritizing their ability to repay over traditional credit scores. Offering swift funding and unique perks like flexible payment dates, it caters to those seeking financial stability. Despite relatively higher interest rates and origination fees OneMain Financial’s commitment to personalized service and accessible lending options sets it apart.

With loans ranging from $1,500 to $30,000 it provides a lifeline for individuals navigating their financial journey. Whether consolidating debt or embarking on a home improvement project OneMain Financial offers a pathway to brighter financial futures.

Dave

Dave is not just another personal finance app; it is a game-changer. Offering up to $500 in short-term loans through its ExtraCash™ feature Dave stands out with its fee-free banking and flexible tipping options. With no required fees and optional tips Dave empowers users to manage their finances with adaptability.

Its commitment to financial flexibility extends to fee-free accounts, no minimum balance requirements and free ATM withdrawals. By prioritizing user-friendly banking and economic alternatives to traditional payday loans Dave redefines personal finance for the modern era.

Moneymutual

MoneyMutual stands out as a reliable solution for individuals seeking swift financial assistance despite less-than-ideal credit. Through its online marketplace of lenders MoneyMutual efficiently connects borrowers with short-term loans up to $5,000 with funds available in as little as 24 hours.

With a straightforward application process taking less than 5 minutes MoneyMutual offers convenience and accessibility to over 2 million customers. Trusted for its efficient prequalification of loan applications and transparent lending practices MoneyMutual provides a reliable platform for those in need of quick financial solutions.

payday loans eloanwarehouse

In the realm of quick financial fixes eLoanWarehouse stands out as a beacon of hope, offering payday loans with a touch of reliability. Unlike traditional payday lenders eLoanWarehouse provides installment loans up to $2,500 swiftly bridging the gap between paychecks without the burden of exorbitant fees.

Backed by the Lac Courte Oreilles Band of Lake Superior Chippewa Indians it ensures accessibility and affordability for those in need. With an emphasis on simplicity and prompt funding eLoanWarehouse emerges as a trusted ally in navigating short-term financial challenges providing a dignified solution in times of urgency.

Lending Tree

LendingTree a renowned online loan marketplace revolutionizes borrowing by offering personalized loan offers from top lenders. With a seamless platform borrowers can explore multiple options without affecting their credit scores. Its strengths lie in efficient prequalification diverse loan products and complimentary credit monitoring.

Borrowers should be wary of potential high-interest rates and additional fees associated with certain lenders. Overall LendingTree empowers individuals to make informed financial decisions tailored to their needs.

Arrowhead Advance

Arrowhead Advance distinguishes itself by offering installment loans up to $1,500 without strict credit score requirements. Unlike traditional lenders, Arrowhead Advance prioritizes flexible credit considerations making it accessible to a wider range of borrowers.

With a focus on providing financial options, Arrowhead Advance operates with transparent terms and a straightforward application process. Borrowers can expect rapid funding and personalized loan solutions tailored to their needs making Arrowhead Advance a reliable choice for those seeking accessible financing.

You may also like: How to cancel OnlyFans subscription in easy steps?

Loanatlast

LoanAtLast stands out as a lending option providing installment loans ranging from $100 to $3,000 with no specific credit score requirement. Unlike traditional lenders LoanAtLast may conduct a credit check but considers individuals with diverse credit backgrounds eligible.

With a focus on accessibility, applicants need to be at least 18 maintain a valid checking account and have a verifiable source of income. Late payments come with a five-day grace period reinforcing LoanAtLast’s commitment to flexibility and customer-centric services.

Upstart

Upstart stands out with its innovative lending model, utilizing artificial intelligence to assess loan applications beyond traditional credit scores. It offers loans ranging from $1,000 to $50,000 catering to individuals overlooked by conventional lenders.

With a pre-qualification option that does not impact credit scores, Upstart provides a seamless borrowing experience. By reporting timely payments to credit bureaus it empowers borrowers to improve their credit history for future financial endeavors.

American Web Loan

American Web Loan stands as a beacon for borrowers seeking installment loans, ranging from $300 to $2,500. With a focus on inclusivity, it caters to individuals with varying credit backgrounds, extending financial solutions even to those with poor or no credit.

Their straightforward application process emphasizes transparency, ensuring borrowers understand terms and conditions clearly. Affiliated with the Otoe-Missouria Tribe in Oklahoma, American Web Loan combines accessibility with a commitment to meeting diverse financial needs.

Opploans

OppLoans stands out as a reliable option for borrowers in need of unsecured installment loans, particularly those with less-than-perfect credit histories. Operating in 37 states, OppLoans offers quick funding within 1-2 days accommodating urgent financial needs.

While it provides flexibility in changing payment dates borrowers should be aware of potentially high interest rates and short repayment terms. Despite these drawbacks OppLoans serves as a viable alternative to traditional payday loans emphasizing accessibility and convenience for diverse financial situations.

Axis Advance

Axis Advance stands out as a lending option offering installment loans ranging from $300 to $700 for first-time borrowers and up to $1,000 for returning borrowers. With a streamlined application process and no minimum credit score requirement Axis Advance caters to individuals in need of quick financial solutions.

Their eligibility criteria include U.S. citizenship, stable employment and a valid checking account making it accessible to a wide range of borrowers. Despite variable APRs ranging from approximately 420% to 780% Axis Advance ensures transparency with detailed fee disclosures in the loan agreement.

Lendingpoint

LendingPoint stands out as a premier choice for borrowers seeking midsize loans especially for home improvements. With a user-friendly mobile app and quick funding, LendingPoint prioritizes convenience.

Their soft credit check for pre-qualification ensures a seamless application process. Despite potential origination fees LendingPoint’s commitment to providing accessible financing makes it a reliable partner for achieving financial goals.

Top Loan Lenders For Bad Credit Like Eloanwarehouse

For individuals with less-than-ideal credit scores several lenders offer accessible solutions akin to Eloanwarehouse. Beam Financial stands out with its streamlined application process and installment loans tailored to bad credit borrowers.

The company prioritizes transparency and flexibility making it an attractive option. Other alternatives like Lendumo Upstart and Possible Finance provide diverse options for those facing financial challenges. These lenders empower individuals with financial options ensuring a seamless borrowing experience despite poor credit histories.

Top Loan Lenders For Good Credit

For individuals with excellent credit, top loan lenders, offer advantageous options with competitive interest rates and favorable terms. LendingTree stands out as a premier online loan marketplace connecting borrowers with personalized offers from leading lenders without impacting credit scores.

These lenders prioritize transparency and efficiency empowering borrowers to explore multiple loan options tailored to their excellent credit profiles. With a focus on customer satisfaction and financial well-being these lenders ensure a seamless borrowing experience for individuals with good credit.

payday loans eloanwarehouse

eLoanWarehouse stands out in the realm of payday loans offering a lifeline of swift funding with installment options up to $2,500. Unlike traditional payday lenders eLoanWarehouse prioritizes affordability, providing a pragmatic alternative for those with imperfect credit.

Owned by the Lac Courte Oreilles Band of Lake Superior Chippewa Indians, it operates under sovereign status, ensuring lenient approval criteria and an uncomplicated application process. With its commitment to financial transparency and responsible lending, eLoanWarehouse emerges as a beacon of hope in the world of short-term borrowing.

Loan Lenders For Debt Consolidation

For those seeking to consolidate their debts, specialized loan lenders like LendingPoint offer tailored solutions. With a focus on borrowers with fair credit LendingPoint provides midsize loans ideal for merging multiple debts into a single manageable payment.

Their user-friendly mobile app and soft credit check make the process seamless, while flexible payment date options enhance convenience. By carefully considering interest rates, fees and reputation, borrowers can find a reliable partner in LendingPoint for effective debt consolidation.

Best Lenders For Installment Loans

For those seeking installment loans Arrowhead Advance emerges as a standout option. With its flexible credit considerations and loans up to $1,500, it caters to individuals regardless of credit scores.

The absence of a strict minimum credit score requirement makes it accessible to a wide range of borrowers. Its variable APRs and transparent fee structure provide clarity and flexibility in borrowing, making Arrowhead Advance a reliable choice for installment loans.

Best Loan Lenders For Home Improvements

For those embarking on home improvement projects, LendingPoint emerges as a top-tier choice. Specializing in personal loans, LendingPoint offers swift funding and a seamless experience with its user-friendly mobile app.

With a soft credit check for pre-qualification, borrowers can access midsize loans tailored for enhancing living spaces. Despite charging an origination fee, LendingPoint’s dedication to accessible financing solutions makes it a reliable partner in achieving your home renovation goals.

Best Short-Term Loan Lenders

In the realm of short-term lending, Dave stands out as an exemplary choice for financial flexibility. As a premier personal finance app, Dave offers up to $500 in short-term loans through its ExtraCash™ feature, all without mandatory fees.

With fee-free banking and a unique tipping option, Dave empowers users to manage their finances adaptably. Its commitment to no credit checks and eligibility tied to monthly income makes it a standout option in the short-term lending market.

payday loans eloanwarehouse

In the realm of swift financial solutions, payday loans have long been a beacon for those in need of immediate cash. eLoanWarehouse emerges as a distinctive alternative, offering installment loans with expedited funding and pragmatic terms.

Unlike traditional payday loans burdened with exorbitant fees, eLoanWarehouse provides a pathway to timely financial relief without compromising fiscal stability. With its straightforward application process and lenient approval criteria, eLoanWarehouse stands out as a beacon of affordability in the dynamic landscape of personal finance.

Best Alternatives For Emergency Loans

When unexpected expenses arise, seeking emergency loans becomes crucial. Among the best alternatives are platforms like CashNetUSA, offering swift same-day deposits for urgent financial needs. Possible Finance stands out for its accessibility, providing up to $500 without a hard credit inquiry.

Beem offers instant cash advances without interest or credit checks, ensuring financial flexibility during emergencies. These options prioritize quick funding and minimal eligibility requirements, making them reliable choices for those facing sudden financial crises.

Best For Military Members

For military members seeking reliable financial solutions, American Web Loan stands out as a trusted option. Offering installment loans ranging from $300 to $2,500, American Web Loan caters to diverse credit backgrounds, including those with poor or no credit.

With a focus on inclusivity and accessibility, their straightforward application process and flexible terms ensure a feasible financial option for those serving in the military. Affiliated with the Otoe-Missouria Tribe in Oklahoma, American Web Loan reflects a commitment to providing essential financial support to military personnel.

Where To Get Loans Like Eloanwarehouse?

In the realm of loan acquisition akin to Eloanwarehouse, diverse avenues beckon borrowers. Traditional banks with their solidity and extensive reach stand as stalwarts of lending. Online lenders offer swiftness and convenience, catering to the digital age’s demands.

Credit unions embody community-centric approaches, fostering inclusivity and member benefits. Peer-to-peer lending platforms decentralize borrowing, opening doors to competitive rates and inclusive access. Each path holds its distinct advantages, tailored to cater to varied financial needs and preferences.

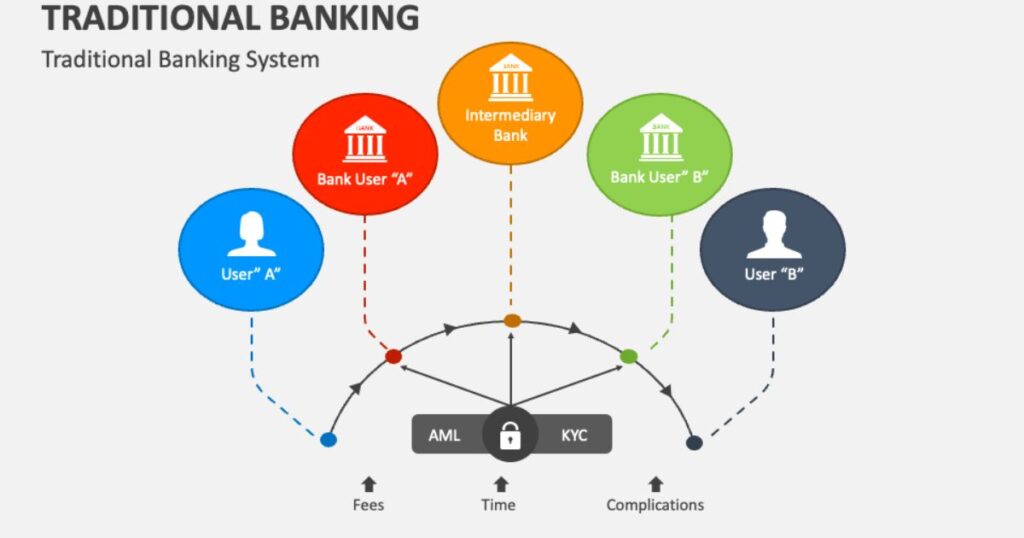

1. Traditional Banks

Traditional banks stand as enduring pillars in the lending landscape, offering a spectrum of financial products and services. With a history of stability and reliability, these institutions provide a trusted avenue for borrowers seeking loans for various purposes.

Despite their conventional approach involving in-person visits and thorough credit assessments, traditional banks remain a cornerstone of the borrowing experience, offering competitive rates and personalized solutions tailored to individual needs.

2. Online Lenders

Online lenders revolutionize the borrowing landscape with streamlined processes and rapid approvals. These digital platforms offer convenience and accessibility, allowing borrowers to apply from the comfort of their homes.

By leveraging advanced algorithms, online lenders assess creditworthiness swiftly, expediting the funding process. With a wide range of loan options and competitive rates, online lenders cater to diverse financial needs empowering borrowers with flexible and efficient lending solutions.

3. Credit Unions

Credit unions operate on a cooperative model, fostering a sense of community and belonging among members. Unlike traditional banks, they prioritize the financial well-being of their members over profits. Offering a range of loan products with favorable terms, credit unions often have more flexible lending requirements and may provide lower interest rates.

Membership in a credit union comes with additional perks such as personalized service and community-focused initiatives making them a compelling choice for borrowers seeking a more personalized and inclusive banking experience.

3. Peer-To-Peer Lending

Peer-to-peer lending revolutionizes borrowing by connecting individuals directly with investors, bypassing traditional financial institutions. In this decentralized model, borrowers create loan listings, and investors choose loans to fund, resulting in competitive interest rates.

P2P platforms leverage technology to facilitate secure transactions, offering a more inclusive approach to lending. With streamlined processes and potentially lower fees, peer-to-peer lending provides an alternative avenue for borrowers seeking financial assistance.

What Are The Banks Offering Loans Like Eloanwarehouse?

In the realm of lending akin to eLoanWarehouse, several banks extend comparable loan products tailored to diverse financial needs. Institutions like Wells Fargo, Chase Bank, Bank of America and Citibank offer personal loans with flexible terms and competitive interest rates.

With their longstanding presence and comprehensive financial services, these banks provide stability and reliability to borrowers seeking swift access to funds. While each bank may have unique application processes and eligibility criteria, they collectively contribute to the dynamic landscape of personal finance, offering alternatives to online lending platforms.

payday loans eloanwarehouse

EloanWarehouse offers an alternative to high-cost payday loans, providing installment loans with swift funding and manageable repayment terms. Unlike payday loans, which often come with exorbitant fees, EloanWarehouse offers a pragmatic choice for individuals seeking quick access to cash without the financial burden.

With installment loans up to $2,500 and an uncomplicated application process, EloanWarehouse aims to address immediate financial needs while promoting fiscal prudence. Positioned as an economically viable substitute, EloanWarehouse prioritizes affordability and accessibility for borrowers with imperfect credit.

What Are The Loan Eligibility And Requirements?

Loan eligibility and requirements vary depending on the lender, but generally, they involve factors such as creditworthiness, stable income, and documentation. Maintaining a healthy debt-to-income ratio and demonstrating financial stability are also crucial.

Applicants need to provide proof of identity, address verification and recent financial statements. Meeting these criteria enhances the likelihood of loan approval and ensures a smoother application process, aligning with the lender’s risk assessment standards.

How To Choose The Right Loan For You?

Choosing the right loan involves careful consideration of your specific needs and financial situation. Evaluate factors like interest rates, loan terms and hidden fees to ensure affordability and transparency. Research reputable lenders and compare multiple offers to find the best fit.

Consider your long-term goals and financial stability when selecting a loan that aligns with your objectives. By making an informed decision you can secure a loan that meets your needs and sets you on the path to financial success.

payday loans eloanwarehouse

eLoanWarehouse stands out in the lending market for offering an alternative to high-cost payday loans. With installment loans up to $2,500 and expedited funding, it provides a pragmatic solution for individuals with imperfect credit.

Owned by the Lac Courte Oreilles Band of Lake Superior Chippewa Indians, it operates under sovereign status offering borrowers a swift financial injection without exorbitant fees. Despite higher APRs and shorter repayment terms, eLoanWarehouse remains a viable and affordable resource for those in immediate financial need, prioritizing accessibility and transparency in its lending practices.

Conclusion

The search for Loans Like eLoanWarehouse unveils a diverse landscape of financial alternatives ranging from traditional banks to innovative online lenders. These options provide borrowers with swift access to funds tailored to their specific needs often without the exorbitant fees associated with traditional payday loans.

From platforms like Beem and CashNetUSA offering instant cash advances to peer-to-peer lending platforms like Upstart leveraging artificial intelligence for credit assessment, there exists a spectrum of choices catering to diverse financial situations.

Whether individuals seek installment loans debt consolidation options or emergency funding the array of lenders available mirrors the dynamic needs of borrowers in navigating their financial journey.

FAQ’s

Are There Loan Lenders Like Eloanwarehouse?

Yes, several loan lenders operate similarly to eLoanWarehouse, providing installment loans with varying terms and conditions. These alternatives offer quick funding and cater to individuals with diverse credit backgrounds, making them accessible options for borrowers.

How Hard Is It To Get A Loan With Eloanwarehouse?

Getting a loan with eLoanWarehouse can be relatively accessible, as they consider diverse credit backgrounds, making it easier compared to traditional banks.

Is Eloanwarehouse A Direct Lender?

Yes, eLoanWarehouse operates as a direct lender, facilitating the lending process directly between the borrower and the lending institution.

Do Other Loan Lenders Provide The Same Loans As Eloanwarehouse?

Yes, several other lenders offer similar loans to eLoanWarehouse, providing installment loans with varying terms and conditions tailored to individual financial needs.

What Is The Alternative To Eloan Warehouse?

An alternative to eLoanWarehouse could be traditional banks, online lenders or peer-to-peer lending platforms offering similar installment loans with varying terms and eligibility criteria.

What Is The Easiest Loan To Get Approved For?

Personal loans from online lenders often have more lenient eligibility criteria, making them among the easiest loans to get approved for.

Does Spotloan Pay Instantly?

Spotloan offers quick funding, but it is not instant, typically, funds are disbursed within one to two business days after approval.

Alexander Quinn is the author behind Filterabout.com. Known for expertise in diverse topics, Quinn’s content on the website reflects a versatile knowledge base catering to various interests.

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Who-Is-Shanin-Blake-Age-Wiki-Parents-Dating-Net-Worth-300x148.jpg)

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Jynxzi-Age-Net-Worth-Career2024-300x148.jpg)

![Kutty Surumi Net Worth, Bio, Age[2024]](https://filterabout.com/wp-content/uploads/2024/05/Kutty-Surumi-Net-Worth-Bio-Age2024-300x148.jpg)

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Who-Is-Shanin-Blake-Age-Wiki-Parents-Dating-Net-Worth-150x150.jpg)