Getting a pleasant deal on a lease car involves several key strategies. First, evaluating charges from more than one provider and dealerships permits you to find the maximum aggressive offer. Websites like Money Shake make it clean to compare offers from franchised dealerships tied to producers or impartial dealerships supported by using banks.

Choosing a shorter rent settlement can prevent cash in the long run regardless of better monthly bills as you grow to be paying less common. Opting for inventory cars conveniently available for hire from providers also can save money and time as they commonly come with preferred systems and are faster to get behind the wheel.

Maintaining the automobile in excellent condition throughout the lease term can save you excess harm prices on the give up potentially through routine renovation or by opting for a preservation package along with your agreement. by following those steps you could make sure you’re getting the excellent possible deal on your hire car.

Compare prices from multiple providers and dealerships

To get the best deal on a lease car, start by comparing prices from multiple providers and dealerships. Use online comparison tools like Moneyshake to easily see offers from different sources. Then, narrow down your options based on the most competitive deals available.

| Action | Description |

| Compare prices from multiple providers | Use online comparison tools like Moneyshake to easily see offers from different sources. |

| Narrow down options based on competitive deals | After comparing prices, focus on the most competitive deals available to get the best value for your lease car. |

Get the best deal on your lease car by comparing prices from multiple providers and dealerships.

Read more Blog: How to Secure Your Vehicle from Electromagnetic Pulse

Choose a shorter lease agreement

When aiming for the best deal on a lease car, consider opting for a shorter lease agreement. While longer terms may lower monthly payments, they often result in higher overall costs due to increased depreciation.

Why Choose a Shorter Lease Agreement?

Shorter lease terms may lead to higher monthly payments but can ultimately save you money in the long run. With less time committed to the lease you will have more flexibility and may avoid potential excess mileage charges. Shorter agreements reduce the risk of encountering issues with extended use of the vehicle potentially saving you from additional fees at the end of the lease.

How to Benefit from a Shorter Lease

By choosing a shorter lease agreement you can minimize your total expenses and enjoy the freedom to upgrade to a new vehicle sooner. Consider your budget and driving needs to determine the optimal lease term for your situation. Shorter leases often offer better value and flexibility, making them a smart choice for savvy car lessees.

Key Points to Remember

- Shorter lease terms may result in higher monthly payments but can lead to overall cost savings.

- Less time committed to the lease reduces the risk of excess mileage charges and potential issues with extended vehicle use.

- Consider your budget and driving habits when selecting the optimal lease term for your needs.

Look for stock cars

When searching for the best deal on a lease car, it’s wise to look for stock cars. These vehicles are readily available from providers and typically come with standard equipment.

By opting for a stock car you can save both time and money as there is no need to wait for the vehicle to be ordered and delivered. Stock cars often offer more affordable lease options compared to custom orders with specific features or upgrades.

Finding a stock car for your lease can streamline the process and get you behind the wheel of a new vehicle sooner. Keep an eye out for these readily available options to enjoy quicker access and potentially lower monthly payments.

Check out special offers

When hunting for the best deal on a lease car do not overlook special offers. These promotions are frequently advertised by providers and leasing companies throughout the year.Special offers often feature discounted lease rates or incentives on a wide range of popular vehicles.

By taking advantage of these deals you can potentially save money and get more value for your lease. Keep an eye out for special offers as they can make leasing a car even more affordable and rewarding.

Search by your budget

To secure the best deal on a lease car consider searching by your budget. Many comparison sites and online providers offer the option to filter results based on your monthly spending limit.

By sticking to your budget you can quickly find lease offers that align with your financial constraints. This approach ensures that you are not overspending and allows you to focus on affordable options that meet your needs.

Read more Blog: Electric Full Suspension Mountain Bike

Choose a lower annual mileage agreement

When aiming for the best deal on a lease car opting for a lower annual mileage agreement can be advantageous. By selecting a lower mileage limit you reduce the risk of incurring excess mileage fees at the end of the lease term.

Choosing a lower annual mileage agreement typically results in cheaper monthly payments as the car depreciation is influenced by the number of miles driven. This strategy allows you to save money while still enjoying the benefits of leasing a vehicle.

Avoid fancy specs and optional extras

To secure the best deal on a lease car it is wise to avoid fancy specifications and optional extras. While these features may seem appealing they often come with additional costs that can inflate your monthly payments.

By sticking to the basics and opting for standard equipment you can keep your lease more affordable. Remember the beauty of leasing lies in accessing a vehicle that fits your budget without unnecessary frills.

Instead of splurging on extras focus on finding a lease deal that offers the best value for your money. This approach ensures you are not overspending on features you may not need or use regularly.

Consider the whole cost

When looking for the best deal on a lease car it is essential to consider the whole cost not just the monthly payments. This includes factoring in expenses such as insurance maintenance and potential end of lease charges.

By budgeting for the entire cost of the lease including additional fees and services, you can avoid surprises and ensure you stay within your financial means. Only by assessing the full picture can you determine if a lease deal truly offers good value for your money.

Remember failing to account for all expenses could lead to financial strain late payment charges or even repossession of the vehicle. Take the time to understand the complete cost of the lease before committing to ensure a smooth and financially sound leasing experience.

Look for cars which hold their value

When searching for the best deal on a lease car, prioritize vehicles known for holding their value well. Manufacturers like Mini BMW and Volkswagen often retain their resale worth better than others which can result in lower lease costs.

Choosing a car with strong resale value means the finance provider would not worry as much about depreciation potentially leading to more favorable lease terms. Keep this in mind when selecting a vehicle to ensure you get the best value for your lease.

Keep the car in good condition

To secure the best deal on a lease car it is crucial to keep the vehicle in good condition throughout the lease term. Adhering to maintenance schedules such as regular servicing and cleaning can help prevent excessive wear and tear.

By maintaining the condition of the car you can avoid potential end of lease charges for damage or neglect. It is routine upkeep or opting for a maintenance package taking care of the vehicle can lead to a smoother leasing experience and potentially lower costs.

Frequently Asked Questions

What is a lease agreement?

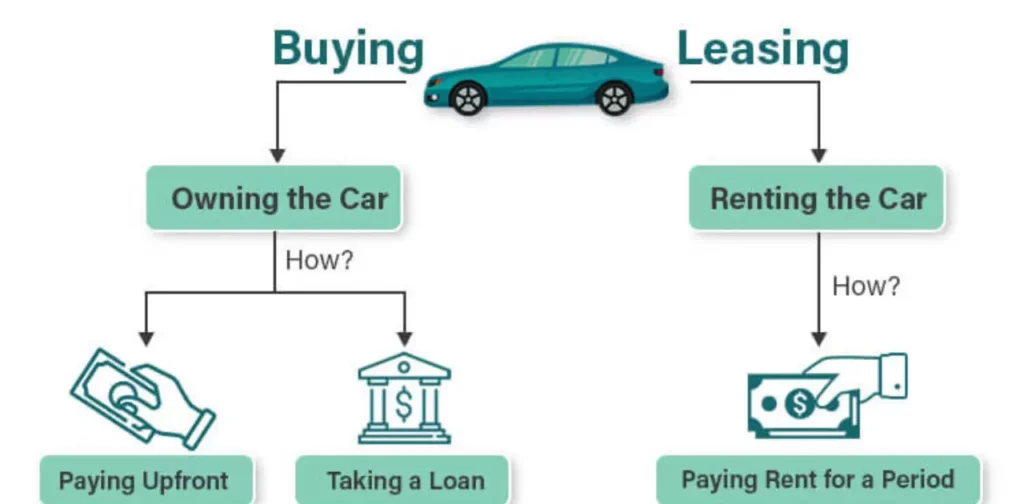

A lease agreement is a contract between a lessor and a lessee that allows the lessee to use the asset such as a car for a specified period in exchange for regular payments.

How long do lease agreements typically last?

Lease agreements usually last between 24 to 36 months, although shorter or longer terms may be available depending on the provider and the lessee’s preferences.

What is included in a lease payment?

Lease payments typically cover the depreciation of the vehicle financing charges taxes and any additional fees specified in the lease agreement.

Can I negotiate the terms of a lease?

Yes, it is possible to negotiate certain aspects of a lease such as the monthly payment, lease term mileage allowance and upfront costs to better suit your needs.

What happens at the end of a lease?

At the end of a lease you have several options including returning the vehicle purchasing it for a predetermined price or leasing or purchasing a new vehicle.

Are there mileage restrictions on lease cars?

Yes, lease agreements typically include mileage restrictions which specify the maximum number of miles you can drive each year. Exceeding this limit may result in additional fees.

What happens if I exceed the mileage limit?

If you exceed the mileage limit specified in your lease agreement you may be subject to excess mileage charges which can vary depending on the leasing company.

Can I customize or modify a leased car?

In most cases lease agreements prohibit significant modifications or customizations to the leased vehicle without the lessor’s consent.Minor alterations may be allowed but it is essential to check the terms of your lease agreement.

Conclusion

Securing the best deal on a lease car requires careful consideration of various factors. By comparing prices from multiple providers choosing shorter lease agreements and looking for stock cars lessees can maximize their savings and value.

Exploring special offers, searching by budget and selecting lower annual mileage agreements can further enhance the affordability of leasing.Avoiding fancy specifications and optional extras, considering the whole cost of the lease and prioritizing cars known for holding their value can contribute to a financially advantageous leasing experience.

Maintaining the car in good condition throughout the lease term is crucial for avoiding additional charges and ensuring a smooth leasing process. By implementing these strategies lessees can navigate the leasing market with confidence and secure the best possible deal on their next vehicle.

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Who-Is-Shanin-Blake-Age-Wiki-Parents-Dating-Net-Worth-300x148.jpg)

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Jynxzi-Age-Net-Worth-Career2024-300x148.jpg)

![Kutty Surumi Net Worth, Bio, Age[2024]](https://filterabout.com/wp-content/uploads/2024/05/Kutty-Surumi-Net-Worth-Bio-Age2024-300x148.jpg)

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Who-Is-Shanin-Blake-Age-Wiki-Parents-Dating-Net-Worth-150x150.jpg)