Calculating your take-home pay after taxes is crucial for understanding your financial situation. When earning $80,000 annually, determining the monthly income after taxes provides clarity on budgeting and financial planning.

Curious about how much of your $80,000 yearly salary translates to monthly income after taxes? Discovering this figure can empower you to make informed financial decisions and effectively manage your expenses.

Utilizing a tax calculator can simplify the process of determining your monthly income after taxes. By inputting your annual salary and relevant tax information, such as deductions and credits, these tools provide accurate estimates tailored to your specific circumstances. Understanding your take-home pay allows you to budget effectively and maximize your financial resources.

Overview Of $80k a year

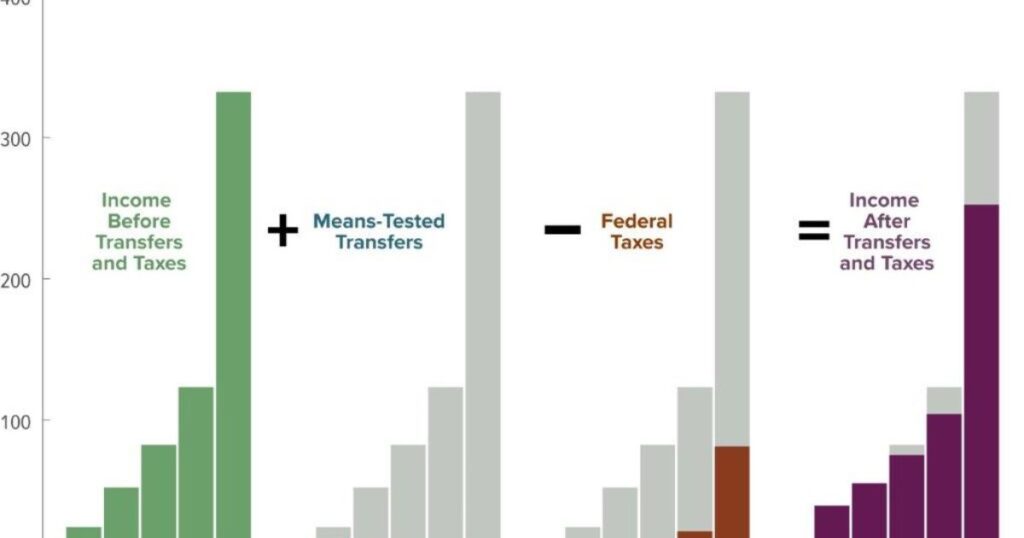

Determining the monthly take-home pay from an $80,000 annual salary after taxes is crucial for financial planning. Utilizing a tax calculator tailored to individual circumstances provides a clear picture of net income. Various deductions, including Federal and State Income Tax, Social Security, and Medicare, impact the final amount.

Understanding these deductions helps individuals gauge their disposable income accurately. Such tools offer insights into tax rates, ensuring informed decisions regarding budgeting and expenditure. UTax calculators facilitate prudent financial management, empowering individuals to optimize their earnings effectively.

How Much Is 80k After Taxes – How Much Tax Do I Have To Pay If I Earn $80000 Per Year? $80k a year

After accounting for taxes on an $80,000 annual income, the net pay stands at approximately $59,552 in Illinois, USA. This includes deductions for Federal and State Income Tax, Social Security, and Medicare. The average tax rate on this salary amounts to 25.6%, with a marginal tax rate of 34.6%.

Comprehensive Guidance For This Blog: Loans Like eLoanWarehouse

After-tax income by state and filing status, offering insights into variations based on location and individual circumstances. Understanding these deductions is crucial for effective financial planning and maximizing take-home pay, ensuring individuals are well-informed about their tax obligations on an $80,000 yearly salary.

An Example For Salary Of $80,000 $80k a year

Consider an individual earning an annual salary of $80,000 in Illinois, USA. After deductions for Federal Income Tax, State Income Tax, Social Security, and Medicare, their net pay amounts to $59,552 per year. This results in an average tax rate of 25.6% and a marginal tax rate of 34.6%.

It’s crucial to note that any increase in salary would incur higher taxation at the marginal tax rate. Understanding these figures provides insight into one’s financial landscape and aids in effective tax planning and management.

$80,000 Income Tax Calculator $80k a year

The $80,000 Income Tax Calculator simplifies the daunting task of determining tax obligations for individuals earning this annual income. By factoring in federal and state tax rates, along with Social Security and Medicare contributions, the calculator provides a clear breakdown of deductions.

It empowers users with accurate estimates of their net pay after taxes, facilitating informed financial planning. This tool ensures individuals understand their tax liabilities, enabling them to make strategic decisions to optimize their financial situation. Assessing monthly or annual income, the calculator offers a valuable resource for navigating the complexities of taxation with ease.

$80,000 After-Tax Income By State And Filing Status [Table] $80k a year

The table on “$80,000 After-Tax Income By State And Filing Status” offers a concise breakdown of net incomes across various states and filing statuses. It provides valuable insights into how location and filing status impact after-tax earnings, aiding individuals in assessing their financial situations.

The table presents clear figures, empowering individuals to make informed decisions regarding their income and tax planning strategies. Whether single, married, or filing as head of household, this resource serves as a valuable reference for understanding post-tax income variations nationwide.

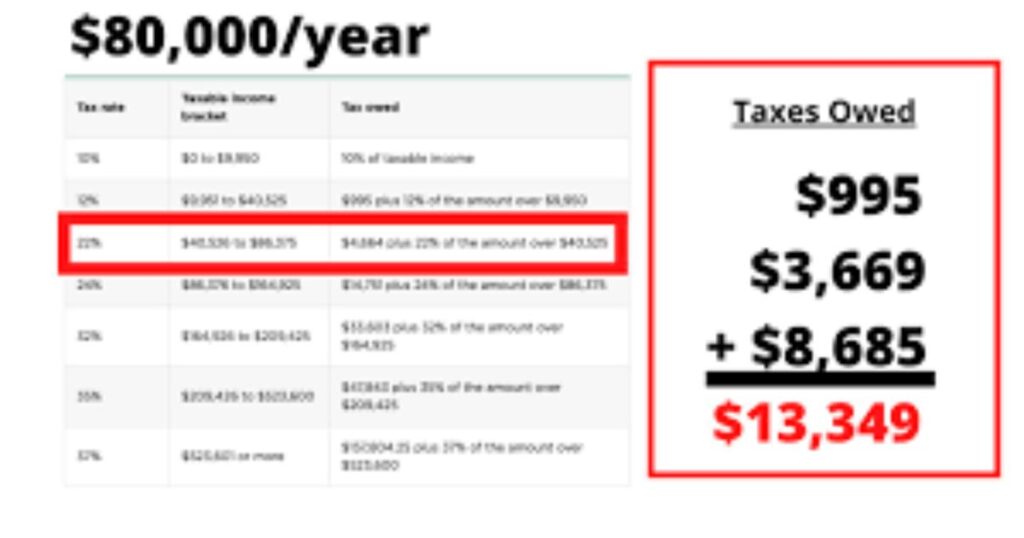

How To Calculate Tax, Medicare And Social Security On A $80000 Salary In The Us? $80k a year

Calculating taxes, Medicare, and Social Security contributions on an $80,000 salary in the US involves a meticulous process. With Federal and State taxes factored in, along with mandatory deductions for Social Security and Medicare, the total tax burden stands at $20,448. This leaves a net pay of $59,552 annually.

Understanding these calculations is crucial for financial planning and ensuring compliance with tax regulations, emphasizing the importance of accurate budgeting and maximizing available deductions to optimize one’s financial situation.

Gross Pay V/S Net Pay On $80000 Annual Income $80k a year

When earning an annual income of $80,000, understanding the disparity between gross pay and net pay is vital. Gross pay represents the total salary before deductions, while net pay reflects the actual amount received after taxes, benefits, and other deductions.

In Illinois, with a $80,000 salary, the net pay would be approximately $59,552 after factoring in Federal and State taxes, Social Security, and Medicare contributions. This significant variance underscores the importance of comprehending the true value of one’s earnings beyond the initial figure.

What Is Income Tax On Salary Of $80000 Annual V/S Monthly? $80k a year

Understanding the income tax implications of a $80,000 annual salary versus a monthly perspective is essential for financial planning. While the annual tax burden may appear significant, breaking it down monthly offers a clearer picture of your disposable income.

Also Read This Blog: How to Cancel BeenVerifiedApp Subscription in Few Minutes?

With annual withholding at $20,448, the monthly equivalent stands at approximately $1,704. This insight enables individuals to better manage their finances and allocate resources effectively throughout the year, ensuring a smoother tax filing process and maximizing their take-home pay.

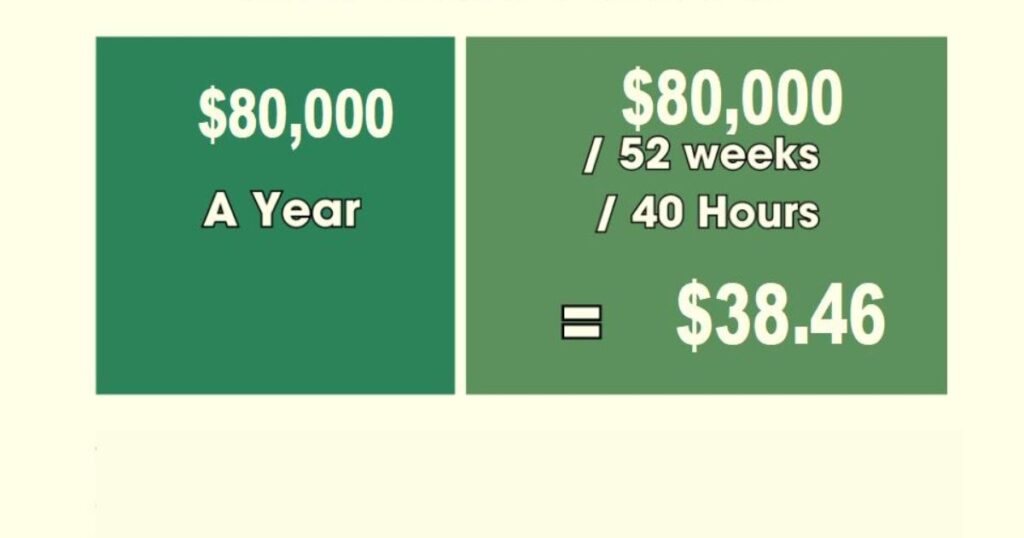

$80,000 A Year Is How Much An Hour? $80k a year

If you’re earning $80,000 a year, your hourly wage boils down to approximately $38.46. This calculation assumes a standard 40-hour workweek across 52 weeks. Breaking it down, each hour you work translates to nearly $38.50.

This hourly rate provides a tangible perspective on the value of your time and effort, offering insight into your income’s granularity. Understanding this hourly wage can help gauge your earning potential and budgeting decisions effectively.

$80,000 A Year Is How Much A Week? $80k a year

If you earn $80,000 annually, your weekly wage amounts to approximately $1,538.46. This calculation assumes a standard workweek of 40 hours over 52 weeks. Breaking down your yearly income into weekly earnings provides a tangible perspective on your financial stability and budgeting.

Understanding your weekly wage helps you manage expenses and plan for savings or investments effectively. Knowing your weekly earnings empowers you to make informed decisions about your finances and future goals.

$80k A Year Is How Much A Month After Taxes $80k a year

After accounting for taxes, an $80,000 annual salary typically translates to around $5,156.67 per month. This calculation considers factors like Federal and State Income Tax, Social Security, and Medicare deductions.

Your net monthly income may vary based on your filing status, dependents, and any additional deductions or credits you’re eligible for. Understanding your after-tax income is crucial for budgeting and financial planning, ensuring you have a clear picture of your take-home pay each month.

What Is The Tax Rate On $80000 Income? $80k a year

The tax rate on an $80,000 income varies depending on factors such as location and filing status. In Illinois, for instance, the marginal tax rate stands at 34.6%, with an average rate of 25.6%. Tax rates fluctuate across states and are subject to change.

Understanding these rates is crucial for individuals to accurately assess their tax obligations and plan accordingly. Whether filing jointly or as a single filer, knowing the applicable tax rates ensures individuals can make informed financial decisions regarding their $80,000 income.

Conclusion

The tax implications of an $80,000 annual income demands careful consideration and understanding. With the aid of tax calculators and comprehensive insights into deductions and rates, individuals can better anticipate their after-tax monthly earnings.

This knowledge empowers them to make informed financial decisions, optimize tax benefits, and efficiently manage their budgetary needs. Harnessing these tools ensures a smoother tax-filing process and maximizes financial well-being for those earning $80,000 annually.

FAQ’s

How Much Is $80000 A Year Per Hour After Taxes?

After taxes, $80,000 per year equates to approximately $38.46 per hour, considering a standard 40-hour workweek and 52 weeks per year. This calculation provides a clear perspective on the hourly wage earned from an $80,000 annual income.

How Much Is $80000 A Year Per Month?

$80,000 annually equates to approximately $6,667 per month before taxes. After accounting for deductions and taxes, the monthly take-home pay typically amounts to around $5,156.67.

How Much Is $80000 Take Home Pay In Texas?

In Texas, after taxes, the take-home pay for $80,000 annually would be approximately $5,244 per month for a single filer, factoring in federal and state income taxes along with FICA contributions.

What Does 80 000 A Year Look Like?

Earning $80,000 a year translates to stability and comfort, allowing for a comfortable lifestyle with room for savings and investments. It provides financial security while offering opportunities for both personal and professional growth.

Is 80k Considered Rich?

Whether $80k is considered rich depends on factors like location, lifestyle, and individual perception, but it generally falls within the middle to upper-middle income bracket.

Can You Live Comfortably On $80000 A Year?

With careful budgeting and prioritization, living comfortably on $80,000 a year is feasible for many individuals.

Alexander Quinn is the author behind Filterabout.com. Known for expertise in diverse topics, Quinn’s content on the website reflects a versatile knowledge base catering to various interests.

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Who-Is-Shanin-Blake-Age-Wiki-Parents-Dating-Net-Worth-300x148.jpg)

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Jynxzi-Age-Net-Worth-Career2024-300x148.jpg)

![Kutty Surumi Net Worth, Bio, Age[2024]](https://filterabout.com/wp-content/uploads/2024/05/Kutty-Surumi-Net-Worth-Bio-Age2024-300x148.jpg)

![Jynxzi Age, Net Worth, Career[2024]](https://filterabout.com/wp-content/uploads/2024/05/Who-Is-Shanin-Blake-Age-Wiki-Parents-Dating-Net-Worth-150x150.jpg)